Why 3PLs Are Accelerating Their Move to the Inland Empire

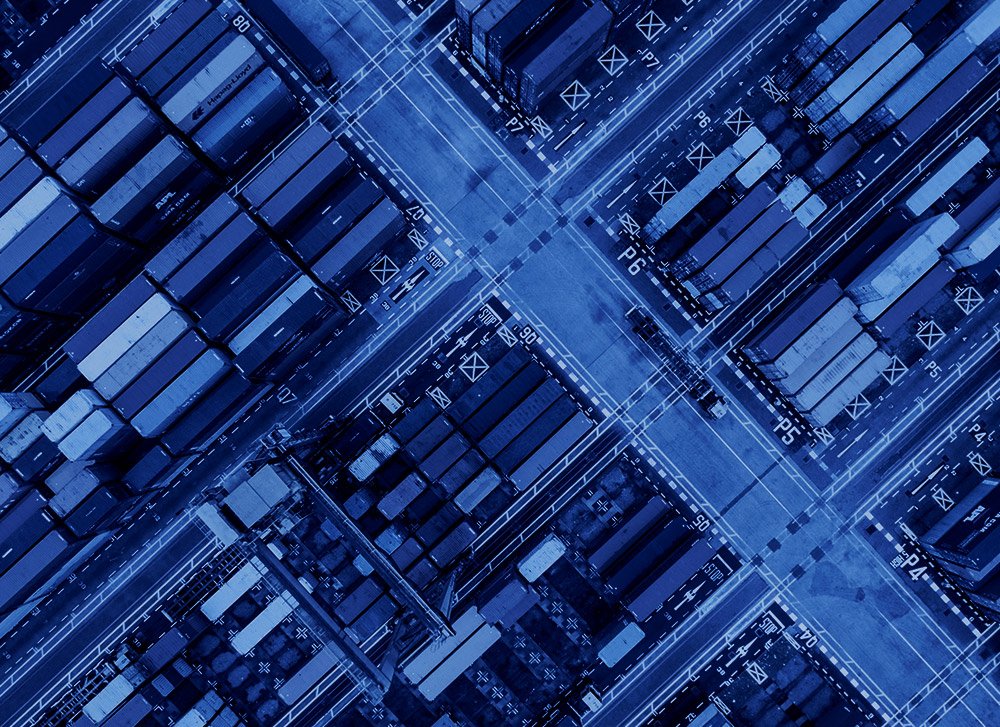

The convergence of strategic location, a highly developed industrial ecosystem, and cost advantages, makes the region indispensable for operators.

Third-party logistics providers, or 3PLs, are rapidly intensifying their presence in the Inland Empire, reshaping the Southern California industrial landscape in the process.

Long recognized as the nation’s premier logistics hub, the Inland Empire now stands as the focal point for both regional distribution and national supply chain strategy. The convergence of strategic location, cost advantages, and a highly developed industrial ecosystem makes the region indispensable for operators under pressure to move goods faster, cheaper, and more reliably than ever before.

Inland Empire Advantages Driving 3PL Relocation

The Inland Empire offers a combination of strategic, operational, and cost advantages that make it a premier destination for 3PLs. Companies looking to optimize distribution networks, reduce overhead, and access a reliable workforce find the region uniquely positioned to support large-scale logistics operations.

Key advantages include:

Strategic location: Direct access to the Ports of Los Angeles and Long Beach allows operators to shorten transit times and reduce drayage costs. Major interstate corridors, including I-10, I-15, and I-215, and freight rail connections via Union Pacific and BNSF enhance regional and national connectivity.

Cost efficiency: Land and occupancy costs are significantly lower than in coastal markets such as Los Angeles or Orange County. Competitive rents for Class A logistics space help 3PLs manage operating expenses while maintaining access to the Southern California consumer base.

Industrial ecosystem: A mature network of warehouses, distribution centers, and supporting infrastructure allows 3PLs to scale operations efficiently. The region also provides a skilled labor pool, from forklift operators to supply chain managers, capable of supporting high-volume logistics operations.

These advantages collectively position the Inland Empire as the backbone of Southern California’s logistics network. For 3PLs seeking to expand capacity, streamline operations, and remain competitive in a demanding market, the region offers an unmatched combination of connectivity, affordability, and operational readiness.

Major 3PL Players and Expansion Moves in the Inland Empire

Notable 3PLs have significantly expanded their Inland Empire footprint in recent years. Global operators such as Maersk, Ceva, iLad and Prompt Warehousing have all executed large-scale leasing and development strategies in the region. Many of these moves involve facilities exceeding one million square feet, underscoring the scale requirements of modern e-commerce fulfillment.

Investment activity reflects this momentum. Institutional capital and REITs continue to acquire and develop Class A industrial products tailored to 3PL demand, including high clear-height warehouses with advanced racking systems and extensive trailer parking. Facility footprints are increasingly designed for automation and robotics integration, signaling that operators are not only chasing space but also reconfiguring their networks for future efficiency.

Strategically, the Inland Empire allows 3PLs to serve both the dense SoCal consumer base and national distribution channels. The region acts as a staging ground for imports, with goods flowing inland through major corridors toward Phoenix, Las Vegas, Dallas, and beyond. By concentrating operations here, 3PLs reduce redundancies in their networks and enhance their ability to deliver on stringent service-level agreements for retail and e-commerce clients.

Market and Real Estate Impacts of 3PL Growth in Southern California

The influx of 3PL activity has reshaped industrial market dynamics. Vacancy rates in the Inland Empire remain among the lowest in the country, even as millions of square feet of new product are delivered each year. Asking lease rates have trended upward, driven by sustained demand for modern logistics facilities that can accommodate high throughput and automation.

Beyond real estate metrics, the labor market has experienced ripple effects. 3PL growth drives demand for a wide spectrum of roles, from entry-level warehouse associates to skilled technicians managing automated systems. Local economies benefit through job creation, while regional supply chain resilience strengthens through concentrated expertise.

Competition for prime sites has intensified, spurring speculative development by major industrial developers. Lease negotiations have grown more complex, with tenants weighing concessions against long-term location security. This heightened activity underscores the Inland Empire’s position as the critical pressure valve in SoCal’s industrial landscape.

Tactical Considerations for 3PLs in the Inland Empire

While the Inland Empire offers unmatched strategic and operational advantages, 3PLs must navigate several challenges to operate efficiently and sustainably. Addressing these obstacles requires careful planning, proactive solutions, and a deep understanding of the region’s industrial landscape.

Key considerations include:

Infrastructure strain: Traffic congestion along major corridors can create delivery delays, while utilities and permitting processes may slow the development of new facilities.

Labor market dynamics: Although the region has a sizable workforce, competition among operators can lead to recruitment difficulties, higher turnover, and the need for ongoing training or upskilling programs.

Environmental and regulatory pressures: California’s strict emissions standards and sustainability requirements impact both facility development and fleet operations. 3PLs must integrate renewable energy, electric vehicle infrastructure, and green building practices to remain compliant and cost-effective.

Successfully addressing these challenges allows 3PLs to stabilize operations, maximize efficiency, and maintain competitiveness in a high-demand logistics market. Strategic investments in workforce development, infrastructure planning, and sustainability initiatives are essential to long-term success in the Inland Empire.

Future Outlook and Strategic Insights for SoCal 3PL Logistics and CRE

Looking ahead, the Inland Empire’s role as a logistics hub will only deepen. Growth corridors are emerging along the I-215 and toward the High Desert, where land availability remains relatively untapped. These areas are poised to accommodate the next wave of industrial development as traditional submarkets tighten.

Technology will be a defining factor. Automation, artificial intelligence, and advanced warehouse management systems are expected to reduce operating costs while increasing throughput. As 3PLs adopt these tools, facility requirements will evolve, further pushing demand for modern, high-spec products.

From a strategic perspective, the Inland Empire is not simply a logistics market. It is the foundation of Southern California’s commercial real estate and supply chain strategy. Its combination of connectivity, scale, and adaptability ensures that it will remain indispensable to 3PL operators navigating both current pressures and future opportunities.

How to Strategically Navigate Southern California’s Commercial and Industrial Real Estate Market

Partnering with industry experts like The Klabin Company can significantly elevate your decision-making process — with over 60 years of experience specializing in the Southern California industrial and commercial markets, we are dedicated to delivering unparalleled service and expertise tailored to your needs. Our deep knowledge of local market dynamics, coupled with our commitment to integrity and innovation, equips our clients with critical insights into emerging trends and opportunities. We prioritize transparency and collaboration, ensuring that your strategy aligns seamlessly with your business’s growth and operational objectives. By leveraging our extensive network and expertise, you can navigate the complexities of the market to position your business for sustained success in this dynamic and competitive environment.

This blog post is provided for informational purposes only and does not constitute legal, financial, or professional advice. Real estate laws and regulations vary by jurisdiction, and the information herein may not be accurate or applicable to your specific situation. Before making any real estate decisions, consult a qualified local real estate attorney, financial advisor, or other relevant professional. The Klabin Company is not liable for any actions taken based on the information in this article.